In 2024, nearly 94% of American adults stated they had a trip planned within the next six months. This has led to a significant increase in travel insurance purchases, especially for those taking international trips.

But what do travel insurance statistics generally look like as of 2024? That’s what we aim to break down. Read on to discover some travel insurance stats, and to further understand why it’s so important to get coverage.

Must-Know Travel Insurance Statistics in 2024

Online insurance comparison platforms like Insubuy are now the fastest growing method to buy travel insurance, with 62% of consumers using them to compare plans before purchasing as of 2022. This trend is only continuing to rise through 2024.

- Total expenditure on travel insurance: Nearly $4 billion†

- Projected American expenditure on travel in 2024: $221 billion††

† https://www.ustia.org/uploads/2/4/8/8/24887869/ustia_press_release_2019_new_study.pdf

While it’s easy to see that travel insurance sales are growing along with travel as a whole, why do travelers purchase coverage? Some of the main components of any travel insurance plan are trip cancellation coverage and travel delay coverage, and the statistics paint a clear picture of why these coverages are so important.

- Number of delayed flights in the USA in 2023: 1,386,699

- Number of cancelled flights in the USA in 2023: 87,943

- Percentage of all flights in the USA that were cancelled in 2023: 1.28%

Source: https://www.transtats.bts.gov/

1.28% of flights being cancelled might seem like a small number, but flights aren’t getting any cheaper. As of Q1 2024, the average price of a domestic airline ticket in the US was $387.24 per the Bureau of Transportation Statistics.

Domestic vs. International Travel Trends

78% of international travelers purchased travel insurance policies that included medical coverage in 2023, while 62% of them purchased policies with trip cancellation or trip interruption coverage. In contrast, only 45% of domestic travelers purchased policies with medical coverage, whereas 70% purchased a travel insurance plan with trip delay or trip cancellation coverage.

Most Popular Methods to Find Travel Insurance Providers in 2024

About 60% of travelers are using online comparison websites like Insubuy to purchase travel insurance in 2024. Independent brokers like Insubuy with comparison platforms allow buyers to easily compare multiple plans from different providers, offering transparency and helping travelers find the best coverage for their needs. This trend is particularly popular among international travelers.

Travel Insurance Statistics by Age Group

- Approximately 45% of travelers ages 18-29 purchase travel insurance. This is a lower percentage than older travelers, as young adults seem more willing to take risks or rely on the basic travel insurance coverage offered by their credit card.

- Around 60% of travelers ages 46-60 years old purchase travel insurance, as they are more concerned about covering their entire family on vacations, or staying protected on business trips.

- Around 70% of travelers 29 and younger use comparison websites or mobile apps to purchase travel insurance due to convenience and familiarity with technology.

The Most Common Reasons for Travel Insurance Claims

Travel insurance can cover a wide variety of situations you may encounter on a trip, and thus the claims made to travel insurance providers vary. These are the most common reasons for travel insurance claims explained.

- Trip cancellation or interruption – Trip cancellation is the primary coverage of any travel insurance plan, and can reimburse you for your prepaid, nonrefundable expenses if you’re forced to cancel your trip for a covered reason such as a personal illness, family emergency, etc. Trip interruption coverage can reimburse you for covered expenses (including a flight home) if a sudden emergency forces you to interrupt your trip.

- Medical emergencies – If you get sick or become injured while on a trip, this is the coverage you’ll want to make sure you have, especially if you’re traveling abroad. Your domestic health insurance won’t do you any good in a foreign country, and you might even find yourself somewhere outside of your PPO network during domestic trips. In either case, emergency medical coverage can save you a lot of money.

- Lost or delayed baggage – While it’s true that your airline may reimburse you, that can take time and there are a lot of stipulations. Lost and delayed baggage coverage can reimburse you for the essential items you need to replace right away.

- Travel delays – Whether it’s bad weather, a mechanical issue with your plane or something else, travel delays can have a ripple effect that messes up your whole trip. They can cause you to miss events or cruises you’ve already paid for, cause your hotel bookings and rental car bookings to change, etc. Travel delay coverage can reimburse you in these sorts of situations.

- Emergency evacuation – In some cases, you may find yourself in a location that is being threatened by a natural disaster, or you may require immediate medical care beyond what is available locally. Emergency evacuation coverage can help by covering necessary evacuation in accordance with the terms of the policy.

- Rental car issues – Rental car coverage may be available through a number of different providers such as your credit card, your car insurance, and of course, a travel insurance broker like Insubuy. We offer a number of travel insurance plans that provide rental car coverage as part of their base coverage or optionally.

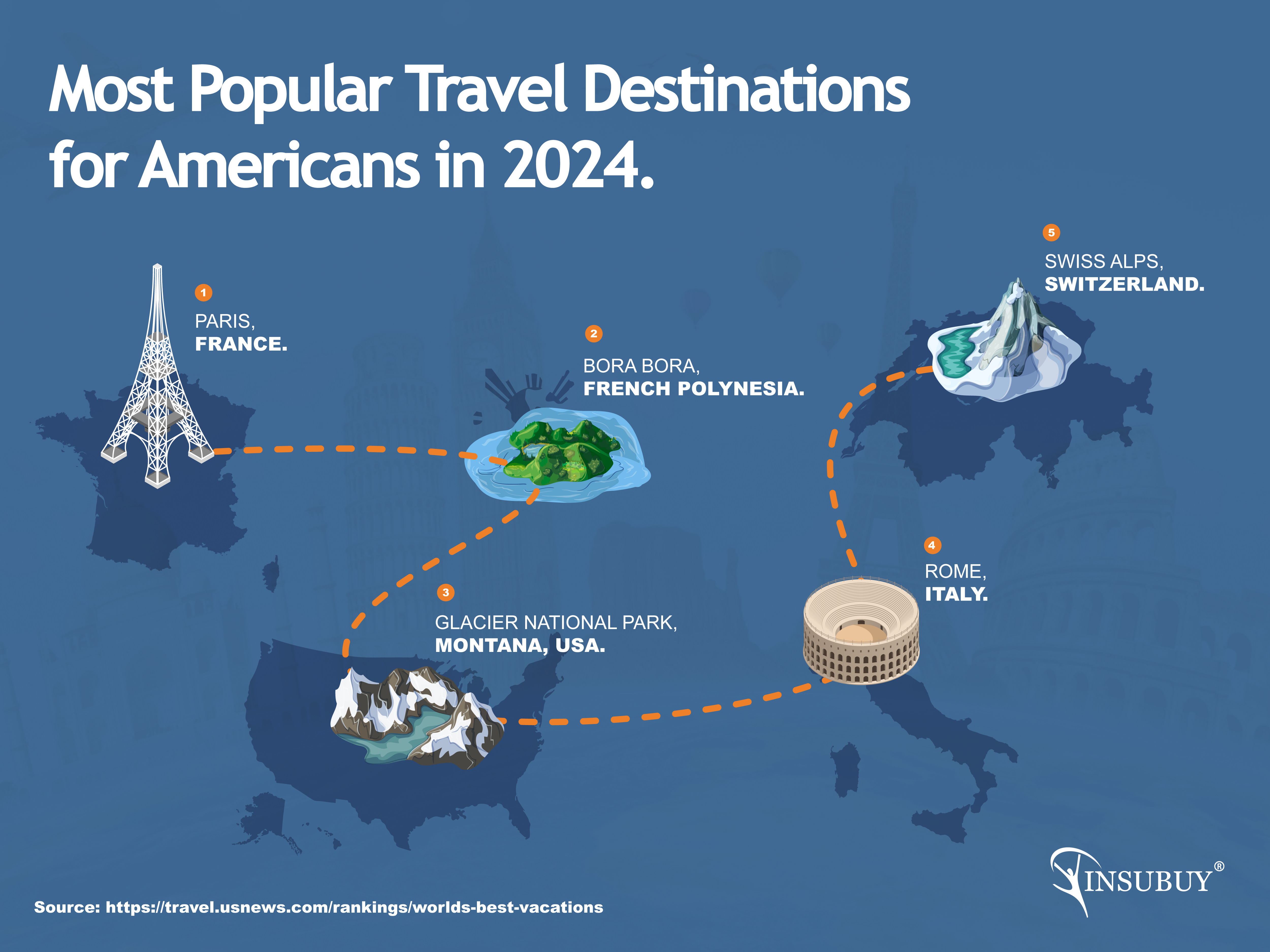

Most Popular Travel Destinations for Americans in 2024

- Paris, France

- Bora Bora, French Polynesia

- Glacier National Park, Montana

- Rome, Italy

- Swiss Alps

Source: https://travel.usnews.com/rankings/worlds-best-vacations/

Frequently Asked Questions About Travel Insurance

What percentage of people use travel insurance?

Currently, around 60% of travelers aged 46-60 and 45% of travelers aged 18-29 buy travel insurance.

How big is the travel insurance industry?

The travel insurance industry is remarkably big, comprising roughly $4 billion in sales in 2024.

How beneficial is travel insurance?

Travel insurance is very beneficial. As we hope we have demonstrated, there are a number of different situations where travel insurance can cover you, and thus save you a lot of money. We encourage you to fill out a quote form today and see all the coverage you can get for just a small percentage of your total trip cost.